Over the course of 2024, we’ve seen new records set in the comic book and original art markets. Conversely, we’ve also seen values level out after the significant uptick in the wake of the COVID-19 pandemic. Last week, Scoop reported on many of the most impressive results that occurred throughout 2024. This week, we talked to comic and art auctioneers and dealers to gain their insight into the market.

Scoop: How would you describe the current market for comics and original art?

Alex Winter, President of Hake’s Auctions (AW): Very strong overall. I can’t say comics are where they were a few years ago during the unprecedented lock down bidding, but prices are still up from where they were pre-pandemic and that is a good sign. Even more so original art, and its one of a kind nature, has shown it is viable and resilient. When that certain piece comes up that collectors have long been looking for, they do not hold back. Not knowing if/when you will ever see it again spurs on spirited bidding.

Vincent Zurzolo, President of ComicConnect (VZ): Comics have been a lifelong passion for me. From collecting, to dealing, to auctioning, over the last 39 years I’ve seen almost everything. What we are currently continuing to witness are adjustments to the market being made in the wake of the pandemic, plus increases in interest rates, inflation, and other economic factors. In 2024, many new sales records have been made, and there are also many items selling for less than they had during the pandemic. Overall, the comic, art, and collectibles markets are very strong and continue to appeal to new generations of collectors, which is excellent for the overall trajectory of the market. In our lifetime, we will see more periods of growth and contraction. It shouldn’t scare us from collecting what we love, only to adjust as well. My advice: keep collecting what excites you, learn about other parts of the market — and, most importantly, have fun!

Rick Hirsch, Director of Marketing for ComicLink (RH): The market for both certified comic books and related comic and fantasy artwork for this past year has been both healthy and very consistent from quarter to quarter over the past two years.

Philip Pettigrew, Art Director, Social Media Director, Consignment Assistant for MyComicShop (PP): We feel the market is in a good place after correcting itself from the pandemic rush. We’re kind of unique in the comic world in that we’re one of (if not the) only places that deals in all kinds of comics from the Victorian Age all the way up to new releases. New comics (both Marvel/DC and independents) are still generating interest and excitement, back issues from the ’80s to the present are seeing more interest as work from that era has started to inform the movie/tv/video game adaptations more, and more collectible Gold, Silver, and Bronze Age books are selling reasonably and steadily.

Scoop: What was your most surprising sale of the year?

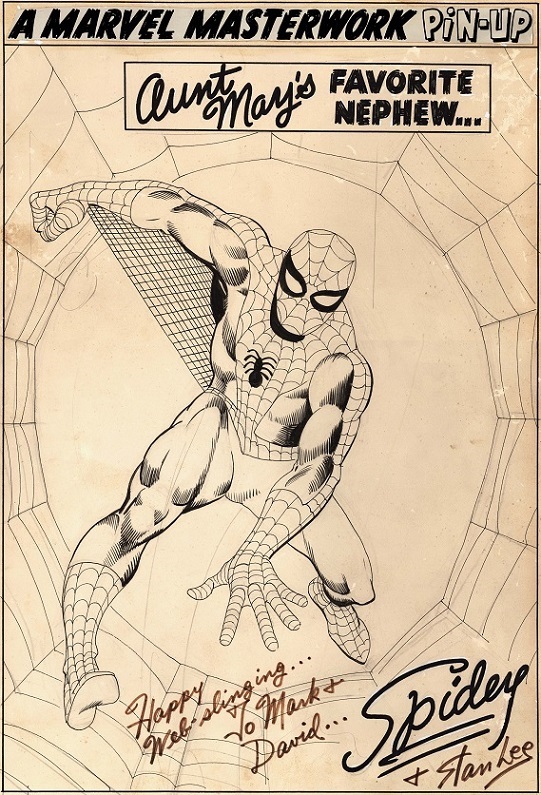

RH: For artwork, the Steve Ditko Amazing Spider-Man Marvel Masterwork Pinup that sold for $590,000. For comic books surprisingly strong sales included Amazing Spider-Man #50 CGC 9.8 for $125,000, X-Men #58 CGC 9.8 for $30,249, and Terrors of the Jungle #17 CGC 8.5 for $19,250.

PP: Giant Comics Editions #12 CGC 8.0 came to us as raw in a large collection being consigned with us stuck in the middle of a longbox full of romance and horror comics and stuck out immediately. Even though we knew it was a great book, we were surprised at both the price it commanded and the speed with which it sold.

AW: I can’t pinpoint any one comic or art sale as surprising. Many items did what we expected, or somewhat better, but we always have realistic expectations and estimates, so it really takes something out of the ordinary to surprise us. After 57 years of auctions we have pretty much seen it all.

VZ: It was really inspiring to see Suspense Comics #3 reaching $82,225 at a restored 4.0, setting a new sales record for an amazing book with one of Alex Schomburg’s most legendary covers.

Scoop: What buying trends did you notice in 2024?

PP: The comic book movie speculation wave seems to have crested with fewer ‘pops’ for indie books that get optioned and less of a gold rush on Marvel and DC books that feature characters or stories that are being adapted. This could be due to the unpredictability of film/tv production and subsequent audience reaction finally setting in for collectors, or it could be because the collectors who were focusing on this kind of material have built up their collections and are no longer horse trading to get what they need. This, of course, doesn’t really apply to Golden Age superhero books which are still selling pretty strongly with wartime issues in particular doing well recently.

Possibly as a result of the aforementioned lower interest in Big Two superheroes, we’ve seen a lot of interest in horror, crime, and romance comics from the Golden Age – particularly (but not exclusively) in the more gruesome/tawdry pre-code covers. The focus on eye-catching or salacious cover art has led to more and more collectors seeking out the work of specific artists – Matt Baker and Alex Schomburg in particular have seen a big upswing as well as more recent artists like Dave Stevens.

AW: High grade remains key when it comes to comics. Those rarely seen grades, no matter what the comic, propel the strong prices. For art it is all about content. Those special covers and splash pages, or key pages in general, remain hotly contested items. Every art collector wants that museum quality piece and the auction results for such pieces have remained impressive.

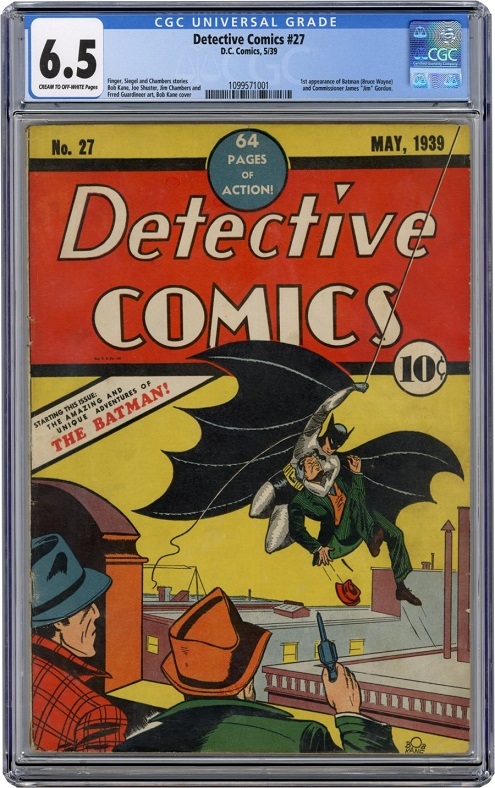

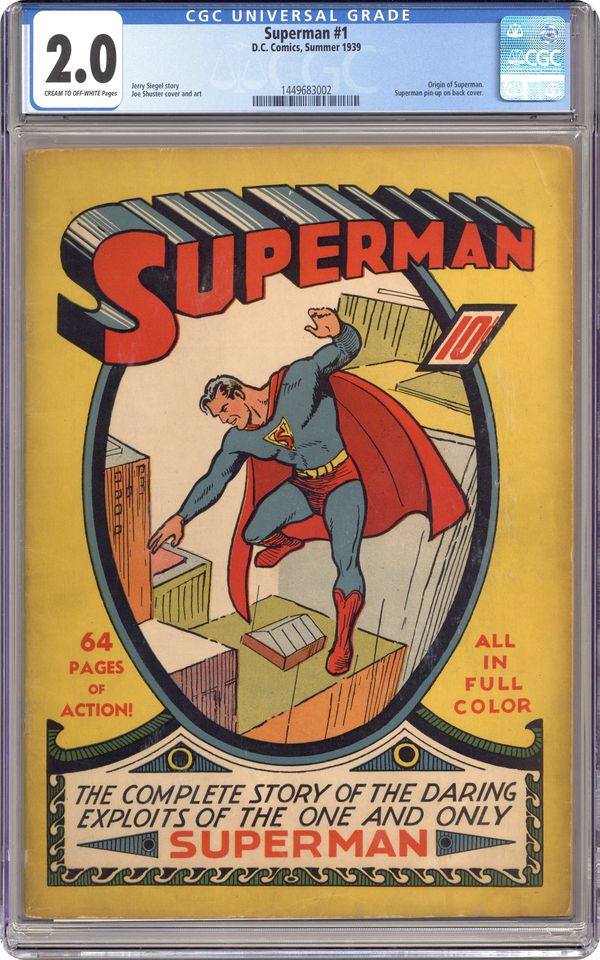

VZ: 2024 saw an exciting spike in Golden Age sales, with many titles setting records across the grades as collectors found new investment opportunities in these pop culture artifacts. It’s also been fun to see the increasing interest in foreign comics, which provide a literal new world of variant covers and even storylines.

RH: Prices for Golden Age comic books were particularly strong with many record prices. In addition to those noted above, some record prices from this era included Adventure Comics #40 CGC 4.0 for $32,000, Champion Comics #10 CGC 9.2 for $25,805, Captain America Comics #13 CGC 8.0 for $25,505, Fight Against Crime #20 CGC 7.0 for $22,312, and Our Flag Comics #5 CGC 3.5 for $21,138.

Scoop: Outside of comics and art, what type of collectibles were big sellers this year?

VZ: Pulps are currently enjoying a revival, with many high grade copies coming back onto the marketplace. We’ve also seen a lot of interest in corporate collectibles. That’s included a top sale for the papers on the Sub-Mariner’s trademark registration for Timely Comics, plus our internal DC documents following the troubled early years of Superman, including Jerry Siegel’s poison-pen campaign against DC executives.

RH: The market for certified video games proved to be solid this past year.

PP: One of the areas we’ve seen a surprising amount of interest in has been oddities like low print run fanzines and one of a kind pieces like Arnold Drake’s prototype graphic novel. Additionally the pulp market is still doing well in much the same way non-superhero Golden Age comics are with sexy or violent covers leading the charge.

AW: For Hake’s, action figures remain a major part of every auction. Star Wars especially, but not far behind are Transformers, Masters Of The Universe, and G.I. Joe (1980s). And of course political memorabilia, which is what Hake’s cut their teeth on back in 1967.